capital gains tax changes 2022

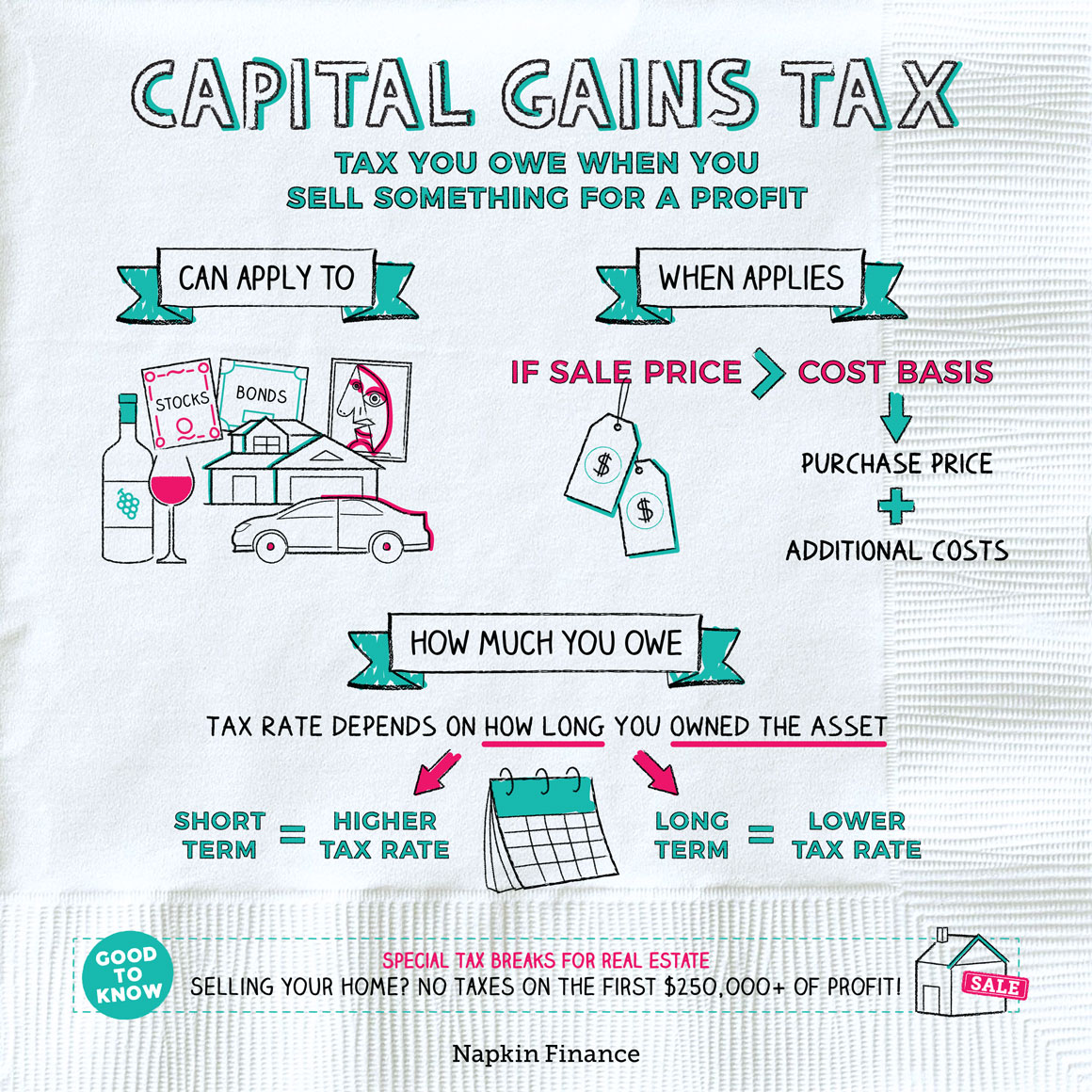

Or sold a home this past year you might be wondering how to avoid tax on capital gains. The capital gains tax on most net gains is no more than 15 for most people.

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Induction package for administrators.

. This doesnt make sense to me. Allows you to increase the cost base by factoring in changes to the consumer price index based on an asset acquired before 1145am on 21 st September 1999 which has been held for more than one year. Make changes to your 2021 tax return online for up to 3 years after it has been filed and.

Capital Gains Tax. The basic tax on long term capital gains is 20 with an addition of extra cess and surcharges like education cess whenever they are applicable. Select from a Variety of Category Specific Legal Forms Packages.

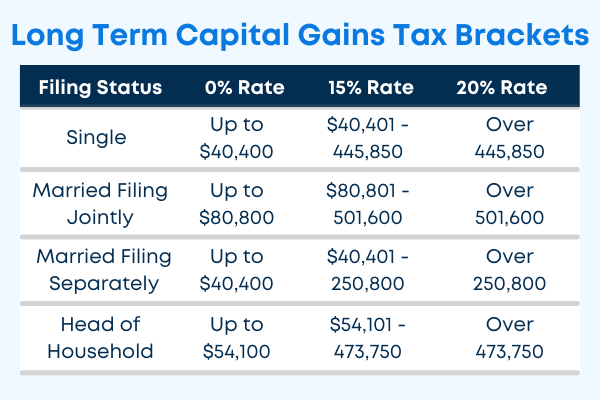

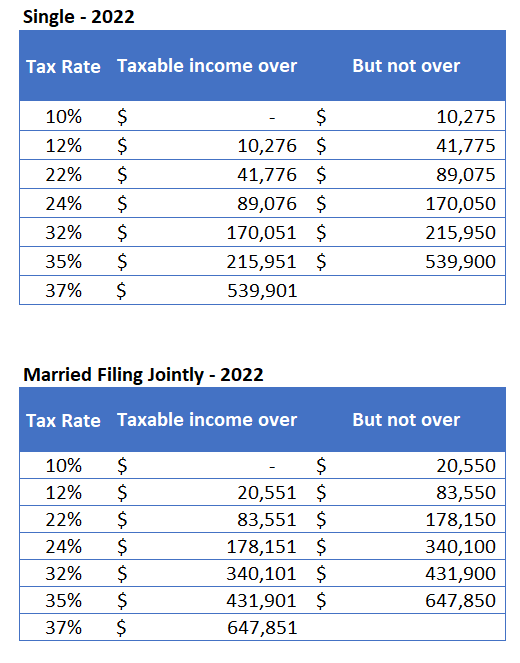

Gains on the sale of personal or investment property held for more than one year are taxed at favorable capital gains rates of 0 15 or 20 plus a 38 investment tax for people with higher. Short-term capital gains are gains apply to assets or property you held for one year or less. In addition to federal taxes on capital gains most states levy income taxes that apply to capital gains.

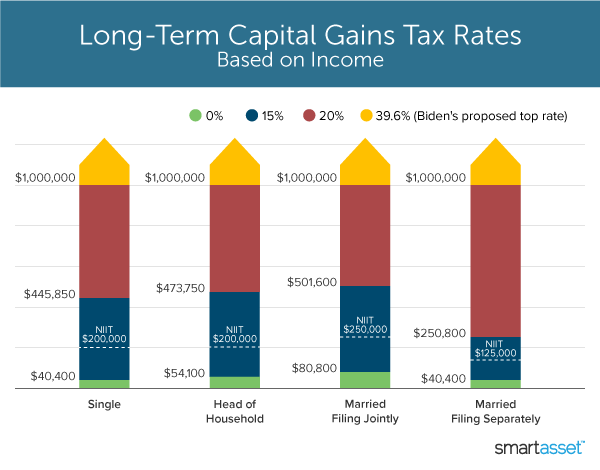

At the state level income taxes on capital gains vary from 0 percent to 133 percent. The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22 to 35 bracket levels. 01 Jul 2022 QC 66013.

How to calculate capital gains tax CGT on your assets assets that are affected and the CGT discount. In 2022-23 you can make tax-free capital gains of up to 12300 the same as in 2021-22. Long-term capital gains tax rates typically apply if you owned the asset for more than a year.

The rates are much less onerous. Long-term capital gains tax rate. You could owe 22429 in taxes on this sale.

This is a simplified version of finding your capital gains tax burden but the basics are there. Ad All You Need to Know About Capital Gains or Losses. When additional income starts making Social Security income taxable its at 50 for a while then 85.

This is a lot even when you remember that you made. This means long-term capital gains in the United States can face up to a top marginal rate of 371 percent. 18 thoughts on 5 Ways To Save Capital Gains Tax On Sale of Property SPatel August 7 2017.

Capital Gains Tax Canada 2022. Theyre taxed at lower rates than short-term capital gains. If the other income is capital gains taxed at 0 then that would make your marginal tax rate 5 then 85 then 13 but the 13 85 of 15 rate would apply until you hit the 25 bracket at which point youd also hit the.

Even taxpayers in the top. If you have a 500000 portfolio get this must-read guide by Fisher Investments. CGT is a tax you pay on the profits you make when you sell an asset.

Ad Hey Taxpayers this is the letter you receive from the IRS when your tax debt gets reduced. Tax policy was a part of the 2016 presidential campaign as candidates proposed changes to the tax code that affect the capital gains tax. What is capital gains tax CGT.

Many people qualify for a 0 tax rate. From 87000 to 890 discuss your eligibility for tax relief with a licensed expert today. Changes to your organisation.

Ad Read this guide to learn ways to avoid running out of money in retirement. The government in an effort to ease the burden of heavy taxes has also provided for certain exceptions under special circumstances. Twenty-one states and DC.

Long-term capital gains apply to assets that you held. That means you pay the same tax rates you pay on federal income tax. Skip advert The 28 limit doesnt apply to short-term capital.

Washington implemented a 7 percent tax on long-term net capital gains in excess of 250000 beginning January 1 2022. Applies resident and non-resident capital gains tax rates and allowances in 2022 to produce a capital gains tax calculation you can print or email. Encouraging NFP participation in the tax system.

A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase price. President Donald Trump s main proposed change to the capital gains tax was to repeal the 38 Medicare surtax that took effect in 2013. The purpose of this Technical Information Release TIR is to.

That means your investments can grow and you dont have to worry about changes in value until you withdraw the funds. Thats because theres no special tax relating to gains you make from investments and. Ad If youre one of the millions of Americans who invested in stocks.

Couples who jointly own assets can combine this allowance potentially allowing a gain of 24600 without paying any tax. Long-term capital gains are gains on assets you hold for more than one year. Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0.

13350 of the qualified dividends and long-term capital gains 83350 70000 is taxed at 0. As of 2021 the long-term capital gains tax is typically either 0 15 or 20 depending upon your tax bracket. Effective for tax years beginning on or after January 1 2002 the Massachusetts Legislature enacted changes regarding the income tax treatment of capital gains and losses under chapter 62 of the General Laws.

The rates are much less. In 2022 individual filers wont pay any capital gains tax if their total taxable income is 41675 or less. Find out how much capital gains tax youll pay on property when you have to pay it and how lettings relief has changed.

But if youre in a higher tax bracket ie 32 35 or 37 then the capital gains tax on your collectible gains is capped at 28. They are subject to ordinary income tax rates meaning theyre taxed federally at either 10 12 22 24 32 35 or 37. CPA availability may be limited.

See the latest 2022 state tax changes effective January 1 2022. If your taxable income is less than 80000 some or all of your net gain may even be taxed at 0. The good news is that the tax code allows you to exclude some or all of such a gain from capital gains tax as long as you meet all three conditions.

Intuit will assign you a tax expert based on availability. Real estate retirement savings accounts livestock and timber are exempt. Tax on Long Term Capital Gains.

A capital gains tax CGT is a tax on the profit realized on the sale of a non-inventory assetThe most common capital gains are realized from the sale of stocks bonds precious metals real estate and property. Go rooting in the Income Tax Act and youll struggle to find something called capital gains tax. For example suppose a married couple filing jointly has 70000 in other taxable income after deductions and 20000 in qualified dividends and long-term capital gains in 2022.

Not all countries impose a capital gains tax and most have different rates of taxation for individuals versus corporations. This percentage will generally be less than your income. Dear Sir Thanks for your valuable article on how to save capital gain tax on sale of land.

The rate jumps to 15 percent on capital gains if their income is 41676 to 459750. Short-term capital gain tax rates. Personal Income Tax I.

I purchased a piece of vacant land in urban area in 2005 through registered sale deed. The maximum zero rate amount cutoff is 83350. Had significant tax changes take effect on January 1st.

CGT applies to assets that you purchased on or after 20 September 1985.

What S In Biden S Capital Gains Tax Plan Smartasset

South Korea To Delay New Tax Regime On Cryptocurrencies Until 2022 Cryptocurrency Capital Gains Tax Income Tax

Capital Gains Tax What Is It When Do You Pay It

What You Need To Know About Capital Gains Tax

Long Term Vs Short Term Capital Gains Tax Ultimate Guide Ageras

2022 Capital Gains Tax Rates In Europe Tax Foundation

State Taxes On Capital Gains Center On Budget And Policy Priorities

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

What You Need To Know About Capital Gains Tax

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Capital Gains Tax What It Is How It Works Seeking Alpha

How Capital Gains Tax Works In Canada Forbes Advisor Canada

Capital Gains Tax Guide Napkin Finance

Latest Income Tax Slab Fy 2021 22 Ay 2022 23 Budget 2021 22 Review Income Tax Income Tax

Why Tax Loss Harvesting During Down Markets Isn T Always A Good Idea Advicers Taxlossharvesting Marketdownturn In 2022 Capital Gains Tax Tax Brackets Investing

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)